Company car tax on electric cars

Is there any tax relief on electric cars in the UK?

Electric car tax explained...

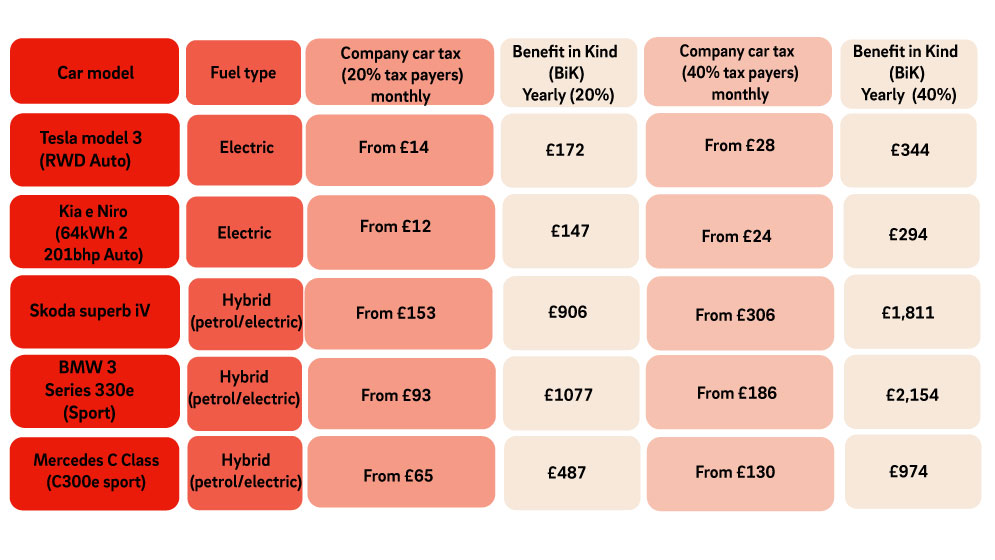

One of the key HRMC tax requirements for company cars is the Benefit in Kind (BiK) tax. The Government have committed to keep this rate at 2% of a cars P11D value (taxable list price & added extras) until April 2025. Whilst the rates are set to go up by a percentage point each year from the 2025/26 tax year, this is still much cheaper than the 22% rate for petrol vehicles and a great incentive to drive electric.

3 tax breaks on electric cars...

Low company car tax

No congestion charge

Company car tax rate 2022/2023

Do electric cars pay road tax?

Vehicle Excise Duty (VED) or Road tax is determined by your car's CO2 emissions, list price, and the year it was registered. Road tax on fully electric vehicles has been frozen at zero until April 2025. After 2025 cars first registered from April 2017 will need to pay VED and new electric-only vehicles will begin to pay in the second year after registration. Even if you don't pay road tax you'll still need to register and renew your road tax each year, but you won't have anything to pay.

Road tax for hybrid cars

Hybrid car road tax is slightly different as there's a combustion engine complimenting the electric battery that powers the car. As with any car the lower the carbon emissions from your tailpipe the lower your road tax will be. The tax is based on vehicles that produce 1 to 50g of C02 per km so if they have low enough emissions, road tax for hybrid cars could also be free.

What's clear is if you have an EV, Hybrid or PHEV you'll be paying significantly less tax that someone driving a diesel car.

Are electric cars exempt from the Congestion Charge?