Our blog

Shining a spotlight on diversity in motorsport is one of the key pillars that brought E.ON and partner Veloce Racing together.

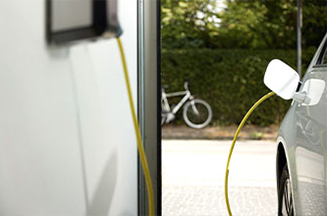

Discover the best type of electric car for your business. We discuss how different models work and how charging costs compare so you can make an informed EV choice.

We’re looking back on some of the key commitments we’ve made over the past year on our journey to making E.ON UK a truly inclusive place to work.

We’re installing the UK’s biggest zoo-based solar meadow at Edinburgh Zoo, and David Field, RZSS CEO, shares how this supports the charity’s net zero goals.

Developers are racing to bring their offices “up to scratch” at a record pace, new data shows, as businesses demand greener, cleaner workspaces.

.jpg)

.jpg)

A firm believer that small changes have a big influence, Kevin Hansen, driver for Veloce Racing, discusses his passion for sustainability.

At E.ON we've played a fundamental role in shaping the future of energy throughout our history - driving the transition to a cleaner, smarter energy system.

Together, E.ON and Extreme E’s Veloce Racing are focused on helping bring education and attention to the need for climate action and a greener, more sustainable future.

Making the most of your home heating can help ensure your winter wellbeing. Having a warm home during the colder months is not only important for our comfort, but for our health.

With the ongoing climate crisis, we’re all aware that we need to take action for climate and save energy at home to help lower our bills.

Creating a sustainable home can sound like a tall order. So we’re sharing seven ways you can make your home more sustainable.

Katy Morris, midfielder and Community Officer for Rugby Borough Women’s FC tells us how support from E.ON is helping to bridge the gap for girls in football.

As the weather turns colder, our thoughts turn to wrapping up warm and reaching for the thermostat. So now is the time to check that your heating is ready for the colder months.

Chris Lovatt, Chief Operating Officer of E.ON UK Solutions, shares some of the ways in which E.ON is helping customers improve the sustainability of their homes.

Helen Bradbury, Chief People Officer at E.ON UK, shares why E.ON is committed to building a diverse and inclusive workforce.

Insulating your home is a great way to make your home more energy efficient, helping to prevent heat loss and reduce your energy bills.

Looking for a new home can be a long and stressful process but knowing what to look for can help make the journey easier.

All you need to know about EPC ratings. Whether you’re eco-conscious, or want to know more about your home’s energy performance, we’ve got you covered.

Here are our top five things you can do to make your home as sustainable and energy efficient as possible, so you’re comfortable all summer long – and ready for winter when it comes.

Kingswinford, in the heart of England, plays host to E.ON’s new sustainable training academy. Here, we’re upskilling our colleagues in cleaner, greener energy solutions.

From large corporations to small enterprises, office spaces are emerging as a crucial focal point in the quest for sustainable solutions.

A roundtable event at Coventry’s MotoFest spectacular explored how cities need to adapt to the climate crisis and how they can get the most out of the green economy.

.png)

As our demand for sustainability grows, so does the need for ‘green champions’ – the people and the skills we need to deliver those necessary changes.

Exploring the Government's ban on gas boilers in 2025. How will it change the way we heat our homes, what will it affect and what are the alternatives?

It can be difficult to know where to start when making your outdoor space sustainable. We’ve pulled together tips on creating a sustainable garden to help tackle the climate crisis.

Designer Helen Kirkum began transforming pairs of shoes destined for landfill into a joyful mishmash of colours, textures and materials, formed entirely of post-consumer waste.

It’s time to act on the climate crisis today, not one day. Read on for seven ways you can take action for climate.

15 minute cities - designed to accommodate life’s necessities by having urban amenities within easy reach - could play a vital part in helping reduce carbon emissions and creating cleaner air in our most populated cities.

Chris Norbury, E.ON UK CEO, talks about inclusion at E.ON and why we’re proud to be supporting Pride.

Architect Richard John Andrews designs with climate change in mind and employs innovative sustainable materials like cork. Plus, his practice is giving something back to his local east London community.

With spring just around the corner, now is a great time to think about what you can do around your home to take action for climate and potentially lower your energy bills.

With the clocks changing, now is the perfect time to take action for climate and make your home more sustainable.

Insulating your home is a great way to make your home more energy efficient, helping to prevent heat loss and reduce your energy bills.

With gas prices remaining high and the climate crisis now at the forefront of many people’s minds, more and more people are starting to consider alternative ways to heat their homes.

Having an energy efficient home can help to keep your bills as low as possible and will also help you to take action for climate and reduce your impact on the environment.

Chris Norbury, our Chief People Officer, answers some of the most common questions you might have about apprenticeships.

Across the world there are people using innovation to help tackle the climate crisis. Here we look at some of these innovators and how they are taking inspiration from nature and technology to find new ways to become more sustainable.

If you’re not sure on how to make your home more energy efficient, Luke - one of our smart meter installers - shares energy saving advice to help lower your energy use and spend.

An organic chef, grower and food sustainability advocate, who shares her knowledge of seasonal cooking, growing produce and her own recipes on Instagram.

Many of us are keen to reduce our impact on the environment, and the conscious decisions we make about the food we buy and eat are a great way to start taking action for climate.

The way we choose to consume fashion impacts the global environment, but there are some simple steps you can take to help reduce the environmental impact of your fashion choices and wardrobe and take action for climate.

An award-winning chef, food educator, writer and climate change activist who believes in a world with a fair global food system.

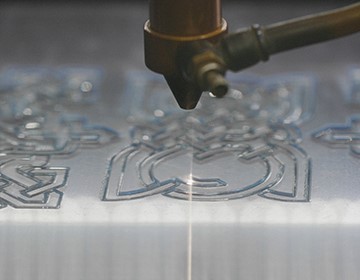

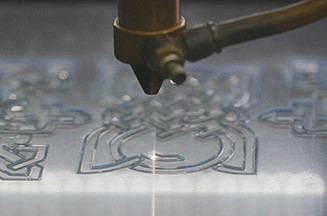

Steam, mass production, digital technology: the three seismic shifts that have revolutionised industry and changed society. So what’s next? The fourth industrial revolution, or Industry 4.0 is smart.

High petrol and diesel prices at the pumps might mean more of us looking into electric vehicles. Here's everything you need to know about where they came from and how they work.

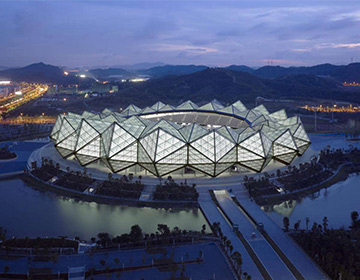

The future of smart cities promises to look vastly different than the present − and it's clear that coming years will bring more mind-blowing advancements to a town near you.

Chris Lovatt, Chief Operating Officer of E.ON UK Energy Solutions discusses how our homes will change in the future to become more sustainable and energy efficient.

A young chef with a passion for local, sustainable food. After studying at Durham University, she created a food blog focusing on gut health, supporting local food growers and reducing food waste.

Our buildings, towns and cities contribute significantly to climate change and to reach net zero by 2050, carbon emissions from this crucial sector must be substantially reduced.

Sport brings people together and it can also provide a beacon for more sustainable development and help to take action for the climate around the world.

ASHPs have been around for many years and people are increasingly considering installing one in their home to help them become more sustainable, reduce their reliance on gas for heating and help lower their energy costs.

With cooler weather on its way, our attention will turn towards our boilers and heating our homes. So, here are five things you should consider to help keep your boiler working at its best all year round.

Thinking about taking action for the climate by buying a new electric car? The UK market for electric vehicle sales is growing every month and the range of makes and models is only set to get bigger and better.

Too hot, too cold…getting the temperature right in your home can be tricky, especially when everyone has a different preferred room temperature.

Do you know what we mean when we talk about the grid? Here we look at what the National Grid is, why it is so important and what exactly a microgrid is.

Read on for five ideas to help you start your journey at home to net zero.

Solar PV doesn't need sunshine to work; daylight alone is enough, making modern solar an appealing option to power your home with renewable energy

Our Carbon Countdown: Road to 2030 white paper looks at the changes needed in order to reach a net zero future. We examine what we can all do and policies needed to ensure the country is able to achieve those ambitions.

Alex Randall oversees many of E.ON’s efforts to help upgrade the nation’s social housing stock. This includes improving the energy efficiency of properties through better insulation, fitting solar PV panels and installing air source heat pumps.

It can be difficult to entertain children over the summer holidays, especially if you want to do so sustainably. But there are ways the family can have fun, without negatively impacting the planet, and even take action for climate.

A new project on the Isle of Skye is investigating ways of protecting electricity supplies to remote or isolated communities, without just building more pylons and power lines.

The effects of climate change could reduce global economic output by 11-14% by 2050, according to international insurance provider Swiss Re. That adds up to a whopping $23 trillion less in worldwide earnings.

By 2030, it will no longer be possible to buy a new petrol or diesel fuelled car in the UK. The ban on sales was brought forward from 2040 and puts the UK on track to become the fastest of the G7 nations to decarbonise cars and vans.

We can’t ignore the climate crisis and the environmental damage global warming is causing. The UK alone produced 406 million tonnes of CO2 equivalent in 2020 – 16% of which came from UK homes.

According to our research, four in five people currently heat their homes using gas, with only 3% heating their homes using a renewable energy source, such as a heat pump.

Solar power is not new, but its future is very bright. Ideas of harnessing the energy of the sun and the know-how behind solar cell technology have been with us for centuries. Today though, solar is currently the fastest growing energy source in Europe.

From London to LA, from Beijing to Budapest, people are breathing dirty air. The Air Quality Life Index found the global average years of life lost per person due to air pollution is more than two, making pollutants an even bigger killer than smoking tobacco.

Choosing renewable energy sources for your home electricity and heating is a great way to reduce your carbon footprint, make your home more sustainable, and potentially lower your energy costs.

With the UK cost of living increasing, it’s well worth being aware of the support that’s available to help improve your home’s energy efficiency, and reduce your energy bills, particularly for those who are most in need.

Clean air is a basic human right. It’s not a privilege, it’s not something that some people should be able to have, and others can’t because they can’t afford it. It’s something we should all have access to.

From the forthcoming ban on the sale of new petrol and diesel cars, to tax incentives and even advertising campaigns, we’re all being encouraged to switch to driving an electric car.